Our Vision

“To generate consistent, secure returns for investors with substantial upside”

Dual City Core Values

PROTECTION

Our integrity is second to none and our primary objective is to protect investor capital.

- We believe in the safety of true diversity. We are not limited to one asset type, or locality.

- We surround ourselves with specialists who can identify multiple value add and exit strategies for each asset.

- In the event that plan A does not happen, we have multiple strategies for every asset.

PROCEDURE

Our due diligence procedure is run through multiple funnels. We try to minimize downside on target assets as much as possible.

- We have a 100% positive disposition history.

- With the experience in exiting over 25 syndications and funds, we have returned 100% of invested capital plus profit distributions.

- We have had a negative yield on ZERO deals

PERFORMANCE

We proudly boast an impeccable track record

- By having vertically integrated investment real estate services we are able to analyze deals through multiple lenses.

- Unlike many of our competitors we do not have to continuously keep purchasing deals to maintain operations.

- We have always placed our investors in the forefront! The management team are also investors themselves.

Dual City Advantage Fund

The Dual City Advantage Fund

is a blind pool, private equity,

evergreen

fund that will emulate the structure of a private UPREIT with the goal of eventually taking it to the public market (IPO). Investors will have the benefit of

cash flow, appreciation, and

opportunities to liquidate their investments.

Dual City: Timeline

Dual City: Timeline

Dual City Advantage Fund

We use state of the art, cloud-based, ultra-secure, and easy to use investor portal by Agora:

- An investment wizard guides investors through the capital raise process including e-signing documents

- Visual dashboards allow investors to view current investment positions and performance metrics

- Notifications update investors when new documents are added to their portal such as K-1s, Investor Statements, and Subscription Documents

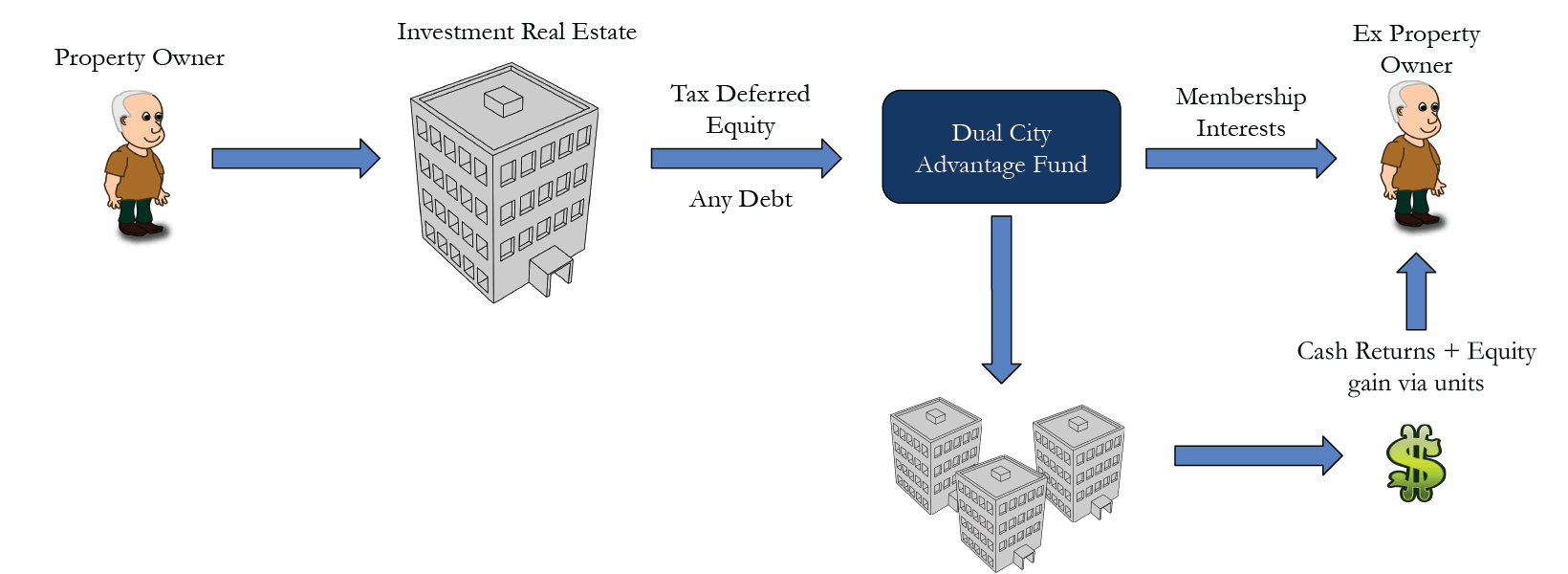

Dual Track Growth Plan

Our “dual track” strategy:

- Traditionally purchase assets using investment capital.

- Absorb properties using a 721 exchange.

By having the ability to present the benefits of “Tax Code section 721” directly to property owners we have a clear distinction to transact where other funds cannot.

DC Advantage Fund: Evergreen

Evergreen = Indefinite Fund Life

To realize our vision, this fund is designed to stay open to give us a strategic advantage of market cycles. We are seeking investors who resonate with our values and share our objective of building long-term wealth and cash flow across diversified markets and asset classes.

DC Advantage Fund: Evergreen

Benefits of a 721 exchange

Section 721 of the US Tax Code allows owners to contribute property to the fund (taxed as a partnership) in exchange for an ownership interest without triggering a taxable event. This benefits property owners ready to diversify without time constraints to take a more passive role and legally defer tax consequences. We have extensively trained brokers of the benefits of the 721 exchange so they can identify and advise property owners. Working closely with trusted brokers will fuel explosive and organic growth of the fund.

- Liquidity- No lock up periods

- Consistent income

- Estate simplification

- Absorb unfavorable debt

- Can sell membership interest over time

- Diversification

- Defer capital gains

- Tax planning

- Long term equity growth

- Activate dormant equity

Dual City: Timeline

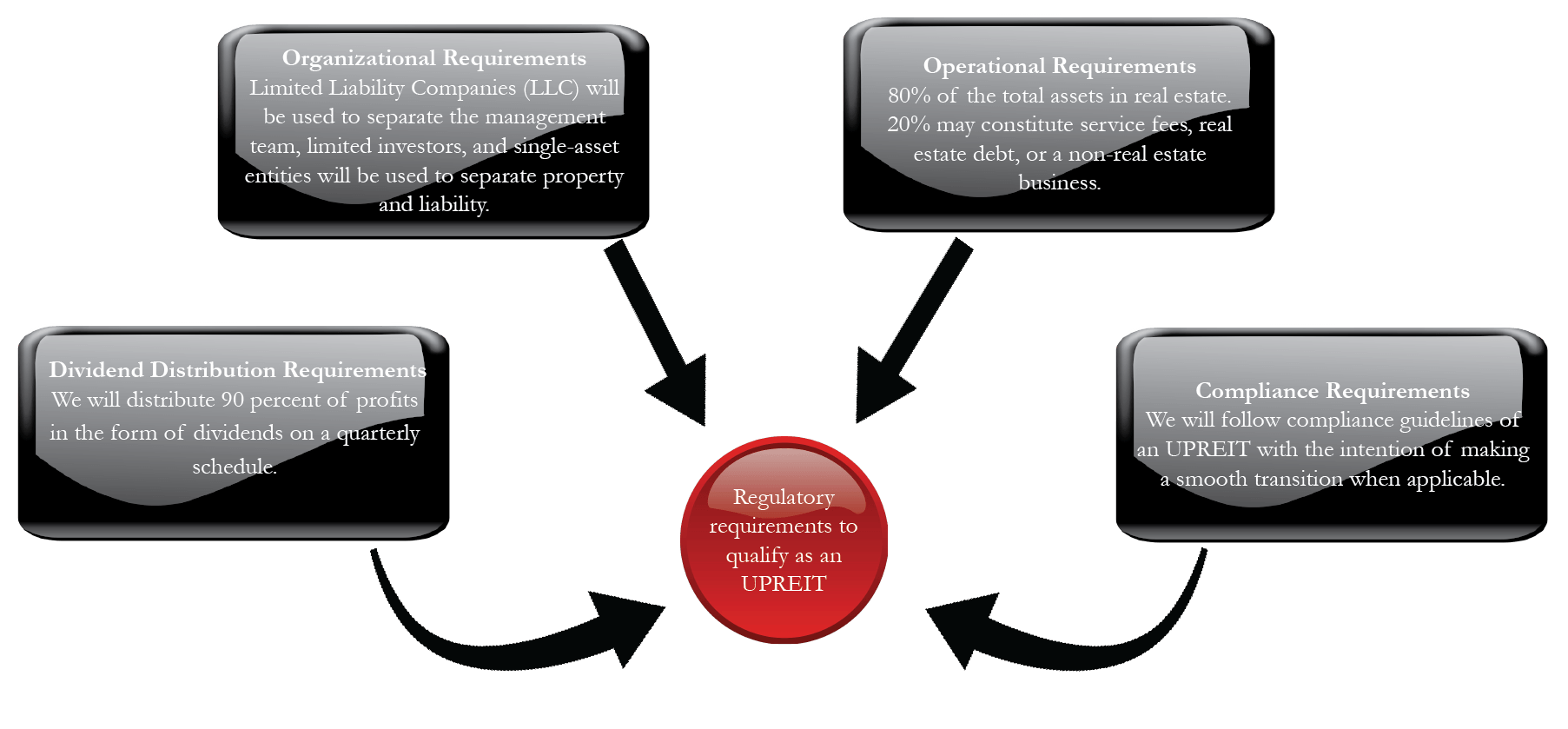

Investment Criteria

• Investment Real Estate – Targeting 80% of the market value of net assets to be invested in real property; office, industrial, multifamily, subdivisions, land development and retail asset types.

• Investment – No more than 20% of such assets may be invested in other instruments such as property debt, public company equity or debt, or the equity or debt of a private operating business.

• Geography – at least 95% of the market value of property net assets must be invested in US markets.

• Lifecycle – Disposition schedule will be determined by market conditions and property performance and be the sole majority decision of the fund managers.

• Diversification – board member will target multiple asset classes across various markets.

• Leverage – targeted 65% leverage not to exceed 75% LTV at board members discretion.

721 Acquisition examples

Owner wants to get out of management and activate equity while deferring capital gains taxes.

Owner who wish heirs to inherit diversified, easily transferable share equity at a stepped up basis.

Owner wants to activate equity and wants a better option for capital gains tax deferment other than 1031 and a DST.

Owner who wish heirs to inherit diversified, easily transferable share equity at a stepped up basis.

Organizational Summaqary

Investment Procedure

The DC Advantage Fund is being structured with the intention of converting it to a publicly traded UPREIT.

The term UPREIT (short for “Umbrella Partnership Real Estate Investment Trust”) refers to an entity structure that allows selling property owners the ability to exchange their real estate ownership for an interest which is converted to a private or public security.

UPREIT benefits to sellers:

1.Deferred capital gains

2.Liquidity- Can cash out share over time

3.Immediate dividends on shares owned

4.Activate dormant equity

5.Can sell property that has unfavorable debt

6.Estate simplification

UPREIT benefits for Investors:

1. Diversification across multiple assets

2. Cash flow + Equity growth

3. Value in owning pre IPO shares

4. Rapid growth; utilizing our vertical real estate services to purchase assets that a cash market cannot

5. Ability to go to cash on the open market

DC Advantage Fund: Reporting

- All investments must be approved by an investment committee to be made up of members of Dual City Advantage Fund Manager LLC (the “Fund Managers”) and other consultants or officers elected to participate in the investment committee by the Fund Managers.

- No less than two officers or Fund Managers are required to independently underwrite all potential investments and present their analysis to the committee.

- Investment committee is to be held on an ad-hoc basis as investments present themselves, allowing for ample time for underwriting and analysis.

- While the Fund Managers generally have the knowledge and information required for making sound investment decisions on behalf of the Fund, the Fund Managers may, at the Fund’s expense, engage experts for their opinion of such investments. Experts are to include but are not limited to appraisers, tax consultants, engineers, general contractors, architects, investment sale brokers, business brokers, and investment bankers.

- Upon the presentation of an investment opportunity, the committee must take a recorded vote in person (to include virtual participation), or by mail, electronic mail, or proxy. Each investment requires a supermajority vote of at least 66% in favor to adopt or engage in the presented investment opportunity.

DC Advantage Fund: Reporting

SWOT Analysis

Strengths

- Acquiring quality assets by offering owners a vehicle to defer capital gains taxes while earning a return and having the ability to go to cash

- Little to zero competition in the mid market CRE niche

- Vertically integrated broker and debt placement services

- Equity growth in perpetuity through all market cycles

- Liquidity: investor ability to sell membership interest over time

Weaknesses

- New competition that can enter market

Opportunities

- Create own footprint in this niche

- Deliver benefits to real estate owners who:

○have large amount of equity in a property

○have a low basis and large tax consequence

○hard to move debt

Thrives with or without 1031 exchange

Threats

- Tax code changes to section 721.

Management Team Bio

DC Advantage Fund: Reporting

Keith Nelson and Michael Migliaccio, the two co-founders of Dual City Investments, met over a decade ago while working in law enforcement.

Keith subsequently left the security of the government to pursue his entrepreneurial passions, ultimately landing in real estate, while Michael maintained his position as a Special Agent with the Federal Bureau of Investigation in NYC. At Dual City Investments, Keith heads the acquisition efforts and leads all strategic initiatives and Mike raises equity capital and fields investors inquires.

As Dual City Investments transitioned from a friends and family shop to a more focused and deliberate and dedicated CRE Investment Firm, Keith and Michael took on partner, Joey Weinel. Joey has a background in mathematics. The three worked tirelessly in the successful closing of Dual City Investments’ inaugural privately placed blind pool equity fund, where they raised capital from investors from Wall Street to Main Street.

In 2020, Scott Williams, founder of Aline Capital, joined the team and brought integration of in-house brokerage services and debt and equity placement. Prior to joining Dual City Investments, Scott helped placed financing and equity of well over $500 mm in transactions.

The latest addition to the core team is Alanna Wojciechowski, she successfully built a marketing and multi-media consulting business before transitioning to real estate and joining the team to foster lasting connections with capital partners.

With characteristics built on fidelity and integrity, our team focuses on providing commercial real estate opportunities with investor security in the forefront.

Contacts

info@dualcityinvestments.com

Phone

+1 864 640 5379

Website

www.dualcityinvestments.com

Main Office

204 Westfield St., Suite 100

Greenville, SC 29601

Disclaimers

The information contained herein does not suggest or imply and should not be construed, in any manner, a guarantee of future performance and/or investment advice. Past performance does not guarantee future results. Any financial projections, forecasts, and analyses (“Projections”) included have been prepared based on numerous assumptions made by the Dual City Advantage Fund LLC and its manager, Dual City Advantage Fund Manager LLC. There can be no assurance that future events will correspond to these assumptions and actual results may or may not approximate any Projections or reflect past performance. No current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended and/or purchased by Dual City Advantage Fund or the manager) will be profitable or equal to corresponding indicated performance levels.

No client or prospective client should assume that any information presented and/or made available in this presentation serves as the receipt of, or a substitute for, personalized individual advice from Dual City Advantage Fund or the manager, or their employees or any other investment professionals.

Reference to a fund or security anywhere in this presentation is not a recommendation to buy, sell or hold that or any other security. This presentation does not represent an offer to sell or solicit an offer to purchase securities; all such offers will be made exclusively by a private placement memorandum. The offering is limited to accredited investors.

VISIT

204 Westfield St.

Suite 201

Greenville, SC 29601 -USA